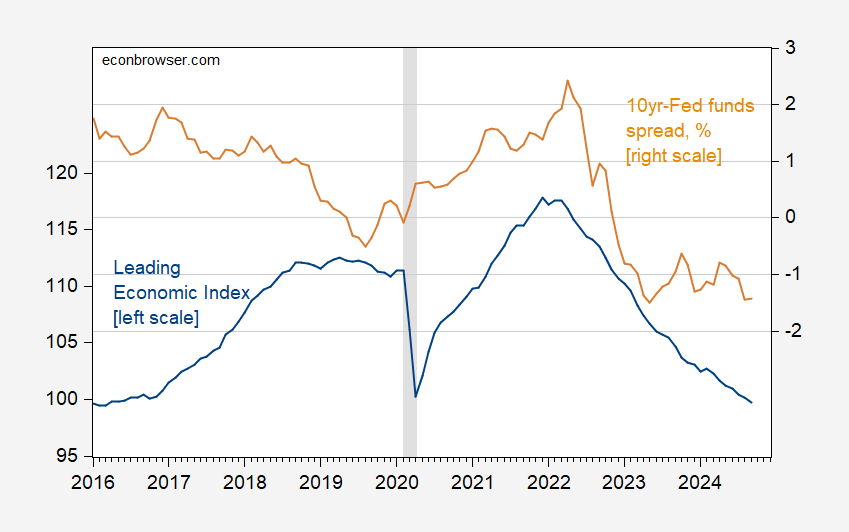

I updated the list of members of the “retreat camp”. Assuming no recession is showing (hear Cam Harvey on this issue), what can we take from the Conference Board’s Leading Economic Index returning to recession territory (it spent most of the last 18 months):

The first thing to note is that the LEI includes (like many indicators of financial conditions) a word that spreads in a certain way. So when the LEI goes down, part of it (I don’t know exactly how much) is due to changes in the term spread.

Figure 1: The Conference Board Leading Economic Index (blue, left scale), and the 10yr-Fed funds spread, % (tan, right scale). The NBER has defined recession days as shaded in gray. Source: Conference Board via TradingEconomics.com, US Treasury, Federal Reserve via FRED, NBER.

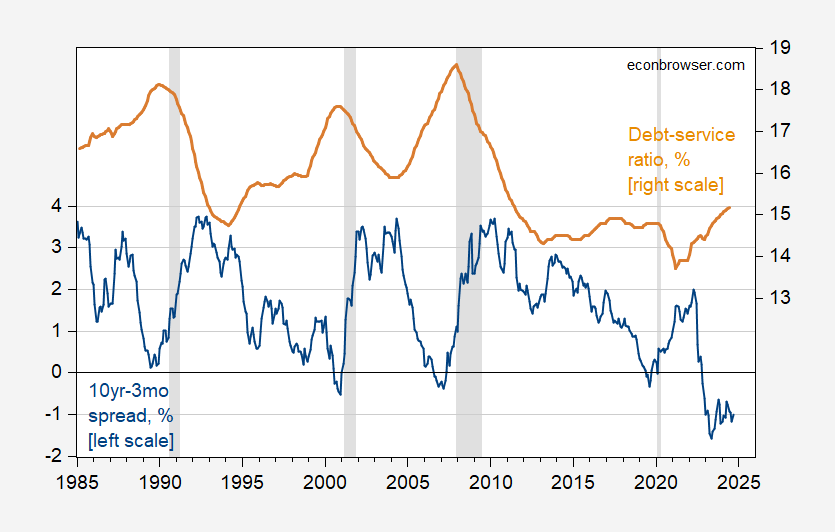

Here is the relevance of this point. The term spread (at the 3-month rate rather than the Fed funds rate) shows a probability of 40% in October, 58% last May. So it’s possible that historical correlation has declined, a recession is coming soon (or it’s already happening and we don’t know). Perhaps important variables are left out. Per Chinn and Ferrara (2024), we argue for a debt service ratio for the non-financial private sector.

Figure 2: 10 years and 3 months Treasury Term spreads (blue, left scale), and non-financial private sector debt service ratio (tan, right scale), both in %. The 2024Q2 debt service ratio is added using the residual amounts of changes in the debt service ratio, 3-month Treasury yield, AAA rating. DSR was translated from quarterly to monthly using linear interpolation. The NBER has defined recession days as shaded in gray. Source: Treasury via FRED, BIS, NBER.

Interestingly, debt service has been low compared to previous recessions.

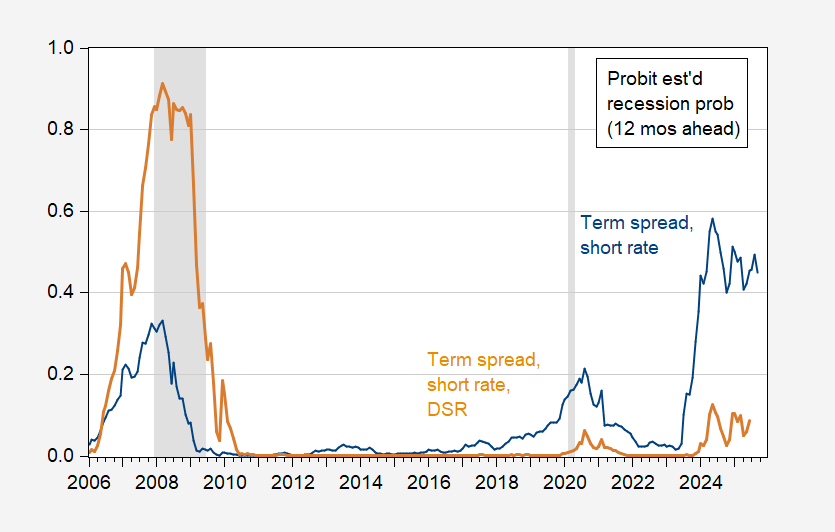

The term spread – extended debt service model (see this post) shows the lowest probability of a recession, while providing the best fit for the 2008-09 recession.

Figure 3: Average 12-month prior probability of a recession, from the narrowing margin in the time spread and the short rate, 1986-2024 (blue), in the time spread, the short rate and the debt service ratio (tan). The NBER has defined recession days as shaded in gray. Source: Treasury via FRED, BIS, NBER, and author’s calculations.

Source link