108.7 vs. 99.5 (Bloomberg consensus). Does good economic news make it to the polls? From the Confidence Board today:

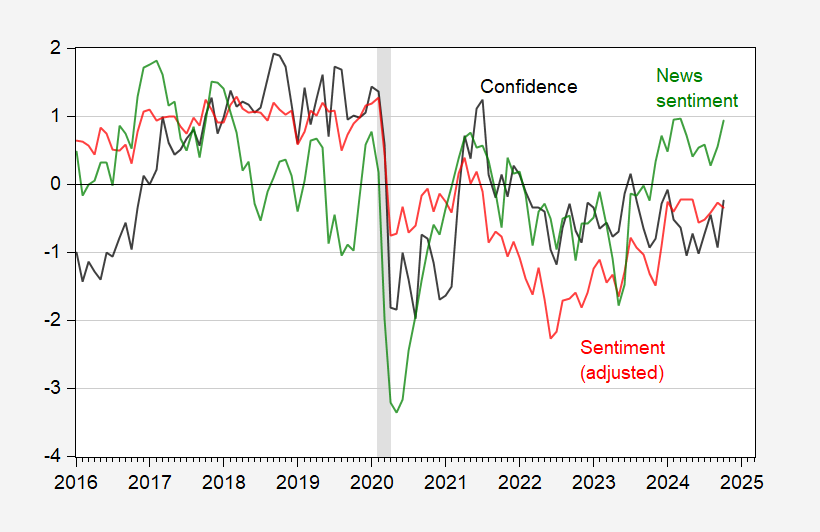

Figure 1: UMich Consumer Sentiment (blue, left scale), Cummings-Tedeschi-adjusted Consumer Sentiment (red, left scale), and Conference Board of Consumer Confidence (black, right scale), Bloomberg consensus (blue square , right scale). The NBER has defined recession days as shaded in gray. Source: University of Michigan via FRED, Conference Board, NBER.

Considering the revised UMich Consumer Sentiment index (in particular Cummings and Tedeschi (2024) discussed here) and the Conference Board’s index of Consumer Confidence, the economic assessment of consumers is significantly clearer than in previous studies.

The change in the confidence index is very large (interesting when taken in addition to the positive revision of the September figure).

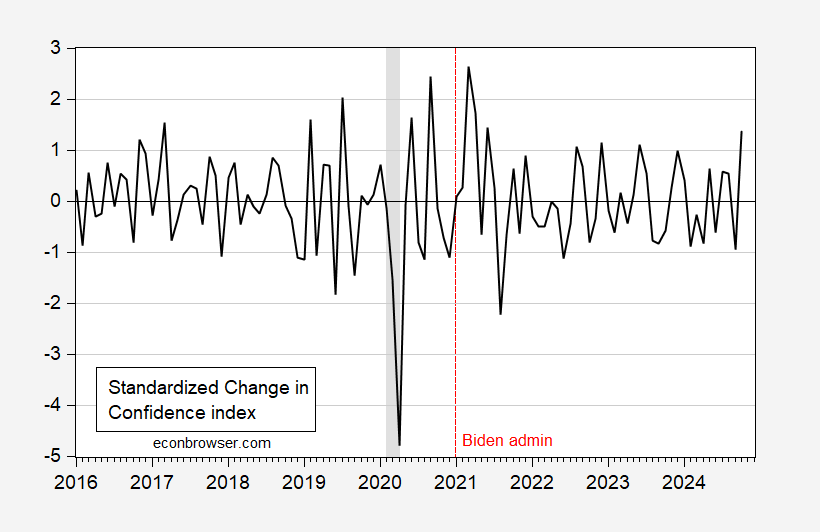

Figure 2: Change in Conference Board Consumer Confidence deflated and normalized by standard deviation 2016-2024M10 (blue). The NBER has defined recession days as shaded in gray. Source: Conference Board, NBER and author’s statistics.

The standard deviation is 1.4 standard deviations – in the period marked by the greatest movement.

Finally, with this reading, the emotional link of the stories is re-established to some extent.

Figure 3: UMich Consumer Sentiment adjusted according to Cummings-Tedeschi (red), and Consumer Board Consumer Confidence (black), and the Shapiro-Sudhof-Wilson/SF Fed News Sentiment index (thru 10/27) (green), everything is degraded and normalized to the standard deviation. . The NBER has defined recession days as shaded in gray. Source: University of Michigan via FRED, Cummings-Tedeschi, Conference Board, SF Fed, NBER and author’s statistics.

Addendum:

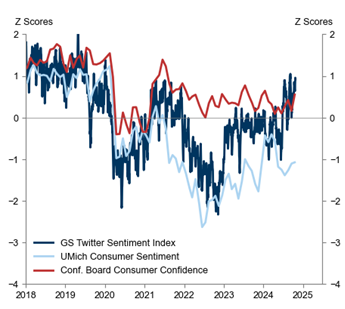

GS provides a comparison of the UMichigan Sentiment index (unadjusted), the Conference Board Confidence Index, and their internal Twitter index.

Source: Hatzius, et al. “USA: Job Openings Below Expectations in September; Consumer Confidence Better Than Expected,” Goldman Sachs Global Investor Research, October 29, 2024.

Source link