Lambert here: It’s hard to see why the “engineering” in “financial engineering” doesn’t have air quotes around it.

By Wolf Richter, editor of Wolf Street. Originally published in Wolf Street.

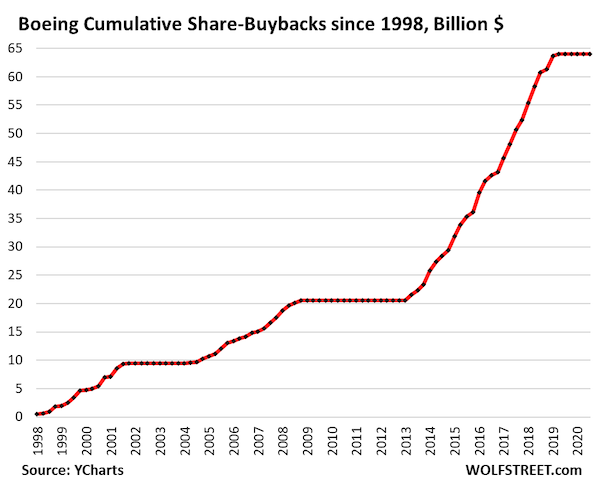

Boeing, which has booked net losses every year since 2019, totaling nearly $32 billion, and has borrowed heavily in those years, bringing its short-term and long-term debt to $58 billion while issuing shareholders’ equity, now the negative. $23.6 billion, it was in dire need of more money to burn, after it wasted and burned $64 billion in stock buybacks to boost its stock.

The company’s infamous pivot from aeronautical engineering to financial engineering to please Wall Street has turned into a huge mess, including shareholders. Wall Street loved it at the time, and shares rose 500% between 2013 and their peak in early 2019. But since then, the stock has gone down and stopped making big gains, and is back where it started at 11 years ago. ago.

So today, after days of rumors about a stock offering, Boeing announced a massive stock offering that will repair some of the damage caused by the stock buyback on its balance sheet, and will cut the bejesus out of current shareholders.

It will sell 90 million common shares (about $14 billion at the current share price) and $5 billion of eligible convertible preferred stock that will qualify as equity for debt-equity purposes. So that’s about $19 billion. It also gave the underwriters the option to acquire an additional 13.5 million shares ($2.1 billion at current prices). And according to a term sheet seen by Reuters, it would increase the mandatory conversion by $750 million.

Together, it will bring the total amount of money outstanding to $22 billion.

The mandatory preferred stock is being marketed to investors at a dividend of 6.0% to 6.5%, and a premium of 17.5% to 22.5% to the stock’s Friday closing price of $155.01, if converted into common stock on or before the maturity date of -October 15, 2027, according to Reuters.

This offering brings much-needed equity capital that the company was recklessly burned by share buybacks before 2019. And it would largely fill the huge hole that is its $23.6 billion net worth.

If Boeing actually raises the full $22 billion, it will reverse nearly half of the balance sheet damage caused by a $43-billion wave of share buybacks in 2013-2019. That wave of share buybacks sent shares up 500% in early 2019, pushing them from $75 to $450.

They are now near $153 right now, where they were in February 2015, down about 66% from the peak, just shy of qualifying for a base in our Imploded Stocks group (data via YCharts).

The dilution of existing shareholders in the offering will be significant: There are 618 million shares outstanding, and adding the 90 million shares offered today will reduce existing shareholders by about 15%. That is before the conversion of the mandatory variables and the option of an additional 13.5 million shares granted to the underwriters. So if and when Boeing becomes profitable again, earnings per share will be diluted by at least 15%.

Boeing halted share buybacks in 2019 as its difficulties mounted after the crashes of two of its 737 Max 8 planes. 20 billion ten years before the Financial Crisis, for a total of $64 billion, the company should have built a brand new airplane to replace the 737. he fired financial engineers and hired some aeronautical engineers (data via YCharts).

Boeing’s corporate credit rating is currently one notch above junk at Moody’s (Baa3), S&P (BBB-), and Fitch (BBB-). There were fears that cash flow problems, production and quality problems, large amounts of debt, and an ongoing strike by 33,000 workers that shut down much of production in September, would cause a recession (our corporate cheat sheet. credit ratings by rating agency).

The junk debt ratio will make it more difficult and more expensive for Boeing to raise the cash it needs to cover its massive bleeding and $12 billion debt repayments due in 2025 and 2026.

With a dividend hike like today’s, the company will have limited financial breathing room, and will likely avoid a near-term low rate of trash, so one day at a time. But it won’t solve the manufacturing and quality problems surrounding its aircraft, its operational problems, and the decades of damage done by financial engineers from the top down on the company.

Source link